Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGTMSE )

Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGTMSE )

Availability of bank credit without the hassles of collaterals / third party guarantees would be a major source of support to the first generation entrepreneurs to realise their dream of setting up a unit of their own Micro and Small Enterprise (MSE). Keeping this objective in view, Ministry of Micro, Small & Medium Enterprises (MSME), Government of India launched Credit Guarantee Scheme (CGS) so as to strengthen credit delivery system and facilitate flow of credit to the MSE sector. To operationalise the scheme, Government of India and SIDBI set up the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

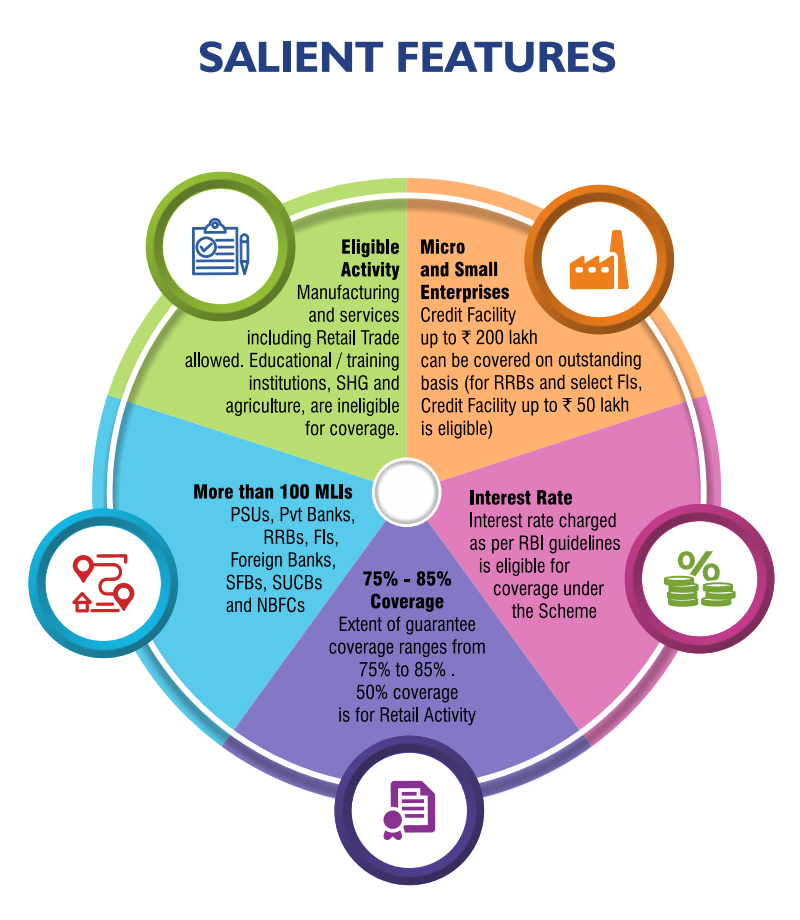

The Trust shall cover credit facilities (Fund based and/or Non fund based) extended by Member Lending Institution(s) to a single eligible borrower in the Micro and Small Enterprises sector for credit facility (i) not exceeding ₹50 lakh (Regional Rural Banks/Financial Institutions);(ii) not exceeding ₹200 lakh (Scheduled Commercial Banks, select Financial Institutions and Non Banking Financial Companies (NBFCs); (iii)not exceeding ₹50 lakh for Small Finance Banks (SFBs)byway of term loan and/or working capital facilities on or after entering into an agreement with the Trust, without any collateral security and/or third party guarantees or such amount as may be decided by the Trust from time to time.

Eligibility:

- New and existing Micro and Small Enterprises engaged in manufacturing or service activity excluding Educational Institutions, Agriculture, Self Help Groups (SHGs), Training Institutions etc. As of now, all activities that come under service sector as per MSMED Act, 2006 are eligible for coverage under the scheme.

- Under the Guarantee Scheme, a borrower is required to obtain IT PAN number prior to availing of credit facility from the eligible lending institution. Also it is a mandatory requirement under section 139A(5) read with section 272(C) of the I.T Act 1961 to indicate IT PAN on all tax documents which include returns, challans, appeals, etc. However, in respect of loans up to 5 lakh, CGTMSE is presently not insisting that the IT PAN be obtained at the time of availing of the guarantee cover. IT Pan No. is to be indicated in respect of credit facility above 5 lakh. Nevertheless, the MLIs have been advised to inform their borrowers to apply for IT PAN number. It is desirable to indicate IT Pan No. in all the application irrespective of the amount. It is advisable to obtain Udyam Registration Number of every borrower and feed it in the system at the time of submission of new application.

- In case of existing units, additional credit facilities in the form of term loan or renewal of working capital facilities can be covered as and when the facilities are extended, provided no collateral security and/ or third party guarantee is obtained. Under the "Hybrid Security" product, the MLIs will be allowed to obtain collateral security for a part of the credit facility, whereas the remaining part of the credit facility, up to a maximum of 200 lakh, can be covered under Credit Guarantee Scheme of CGTMSE. CGTMSE will, however, have pari-passu charge on the primary security as well as on the collateral security provided by the borrower for the credit facility.

- Credit facilities can be extended by more than one bank and/or financial institution jointly and/or separately to eligible borrower up to a maximum limit of 200 lakh per borrower subject to ceiling amount of individual MLI or such amount as may be specified by the Trust. However, sharing of securities will not be permitted.

Annual Guarantee Fee (AGF)

AGF will be charged on the guaranteed amount for the first year and on the outstanding amount for the remaining tenure of the credit facilities sanctioned / renewed to MSEs on or after April 01, 2018 as detailed below (Refer Circular No.139/2017-18 dated February 28, 2018):

| Annual Guarantee Fee (AGF) [% p.a.]* | ||

|---|---|---|

| Women, Micro Enterprises and Units covered in North East Region | Others | |

| Up to ₹5 Lakhs | 1.00 + Risk Premium as per extant guidelines of the Trust | |

| Above ₹5 Lakhs and up to ₹50 Lakhs | 1.35 + Risk Premium as per extant guidelines of the Trust | 1.50 + Risk Premium as per extant guidelines of the Trust |

| Above ₹50 Lakhs and up to ₹200 Lakhs | 1.80 + Risk Premium as per extant guidelines of the Trust | |

| Retail Trade (₹10 lakh to ₹ 100 lakh) | 2.00+ Risk Premium as per extant guidelines of the Trust | |